How much house loan should i take

Get All The Info You Need To Choose a Mortgage Loan. 36000 of gross income less fixed monthly expenses.

5 Ways To Calculate How Much House You Can Afford Refinance Mortgage Refinancing Mortgage Mortgage Interest Rates

Fill in the entry fields and click on the View Report button to see a.

. You would need 64980 for a 20 down payment and thats not including closing costs or any cash reserves left over. Fortunately the typical down payment amount that first. Ad Purchasing a Home Is a Big Decision.

If applicable your total mortgage payment includes the principal interest real. Estimated monthly payment and APR example. Medium Credit the lesser of.

Depending on your credit score you may be qualified at a higher ratio but generally housing expenses shouldnt exceed 28 of your monthly income. But in areas with high home values that limit increases to 212550. President Joe Biden on Wednesday announced a sweeping student loan forgiveness plan of up to 10000 per borrower or up to 20000 for those with Pell Grants.

For instance if your take-home salary is Rs. A home loan amount which is 70 of the value of the property is ideally considered safe. The maximum loan you can avail depends on the maximum EMI you can pay from yourmonthly disposable income which is fixed as a percentage by the.

The type of loan you choose can set the tone. Get Your Best Interest Rate for Your Mortgage Loan. If you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt payments are 2000.

Ad More Veterans Than Ever are Buying with 0 Down. This means your monthly payments should be no more than 31 of your pre-tax income and your monthly debts should be less than 43 of your pre-tax income. Get Started Now With Quicken Loans.

Apply Easily Get Pre Approved In 24hrs. Compare Quotes Now from Top Lenders. In most parts of the country income cannot be more than 86850 to take out a USDA loan.

Check Eligibility for No Down Payment. Mar 20 2018 Home equity is great for homeowners looking to take out a low interest loan. Ad Learn More About Mortgage Preapproval.

Let us Help You Find the Right Budget for You. Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Browse Information at NerdWallet. However these limits can be. Its A Match Made In Heaven.

The take-home salary will determine the EMI amount you can afford and thus the total loan amount you can borrow. The 2836 rule states that your front-end DTI ratio shouldnt be more than 28 and your back-end DTI. Good Credit the lesser of.

Were Americas 1 Online Lender. The first step in buying a house is determining your budget. 25000 you can avail as.

Rules of Thumb for How Much To Spend on a Mortgage The 2836 Rule. A 225000 loan amount with a. 42000 of gross.

Lowest Home Financing Rates Compared Reviewed. Wondering What Your Home Budget Is. Nevertheless depending on a case-to-case basis an applicants repayment capacity should be.

Minimum down payment by loan type. See how much your monthly payment could be and find homes that fit your budget. Get Started Now With Quicken Loans.

This includes your principal interest real estate taxes hazard insurance association dues or fees and principal mortgage insurance PMI. In other words monthly housing costs should not exceed 31. Ad Compare Mortgage Options Get Quotes.

Find out how much house you can afford with our home affordability calculator. 36000 of gross income or. Its A Match Made In Heaven.

This mortgage calculator will show how much you can afford. Looking For A Mortgage. Looking For A Mortgage.

Ad Compare Mortgage Options Get Quotes. Choose The Loan That Suits You. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

The White Houses plan will forgive federal student loan debt for borrowers who earned less than 125000 -- or less than 250000 for heads of households or married couples. To be approved for FHA loans the ratio of front-end to back-end ratio of applicants needs to be better than 3143. Apply Today Enjoy Great Terms.

Ad Find Mortgage Lenders Suitable for Your Budget. Were Americas 1 Online Lender. Take Advantage And Lock In A Great Rate.

Under the administrations plan anyone earning less than 125000 or married couples earning less than 250000 will qualify for up to 10000 in federal student loan. A home equity loan is a loan in which borrowers use their house as collateral. Compare Quotes See What You Could Save.

Lender Mortgage Rates Have Been At Historic Lows. Wondering how you can take advantage of low down payment options. 28000 of gross income or.

Start Here to Discover How Much You Can Afford. Your housing ratio shouldnt exceed 29 of your gross monthly income income before taxes. Ad Highest Satisfaction For Home Financing Origination.

A homeowner or tenant earning 50000 each year should spend up to 1250 to 1667 monthly for housing costs to keep home affordability under check. Use this down payment calculator to help you answer the question how much should my down payment be.

How Much House Can I Afford Buying First Home Home Mortgage Mortgage Marketing

Know The Difference Between A Home Loan And Plot Loan Home Loans Plots Loan

How Much House Can I Afford Insider Tips And Home Affordability Calculator Home Buying Process Buying First Home Home Buying Tips

How Much Home Loan Can You Take Home Refinance Home Loans Loan

How Much House Can You Afford Home Loans Loan Company Mortgage Companies

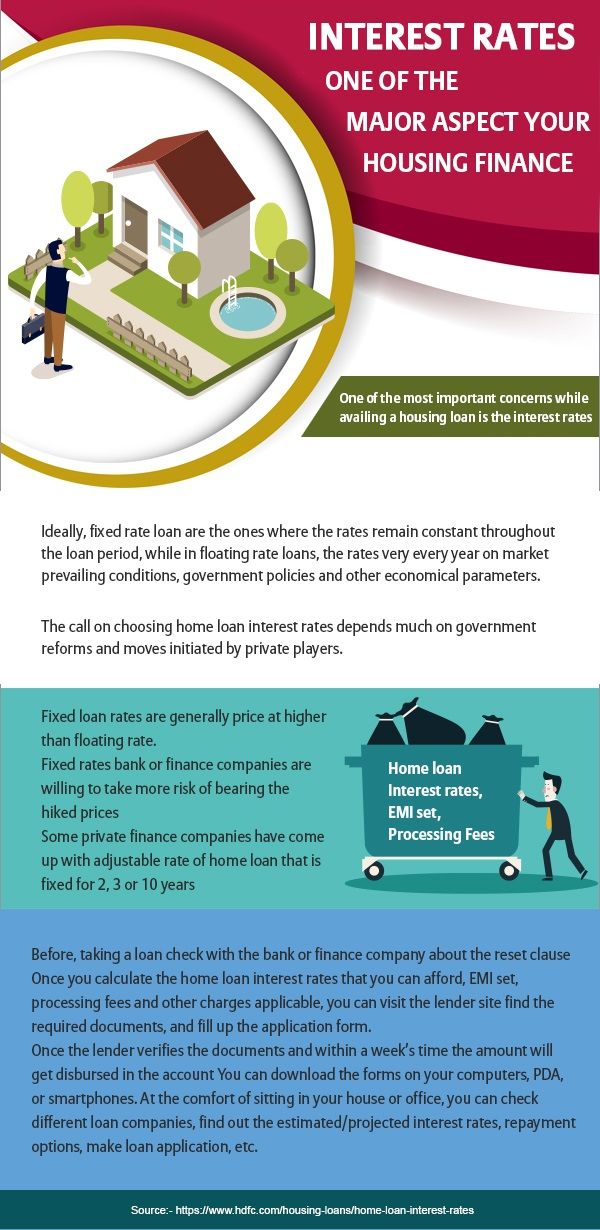

House Loan Interest Rates Create A Space Of Your Own With Hdfc Home Loans Best Housing Loan Interest Rates For Loan Interest Rates Home Loans Interest Rates

Pin On Dream Big Home Remodel

Pin On Fairway Mortgage Colorado

Check Out The New Maximum Fha Loan Amount If You Are Interested In Seeing What Loan Type Is Best Fo Mortgage Lenders Mortgage Loan Originator Home Mortgage

3 Mortgage Automation Tricks That Will Take Years Off Your Home Loan Mba Sahm Home Loans Mortgage Home Mortgage

How Much House Can I Afford Real Estate Advice Real Estate Education Real Estate Tips

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Buying Your First Home

Before You Start Shopping For A New Home Determine How Much You Can Afford To Spend By Considering Your Credit Score Monthly Inc Home Loans Home Buying House

Best Home Affordability Calculator

Physician Mortgage How Much Home Can I Afford Preapproved Mortgage Mortgage Corporate Brochure Cover

Mortgage Calculator Arrest Your Debt Mortgage Calculator Free Mortgage Calculator Mortgage

House Improvement Loan As The Name Suggests Are Provided To Individuals For The Purpose Of Improving Or Making The Home Home Loans Home Improvement Loans Loan